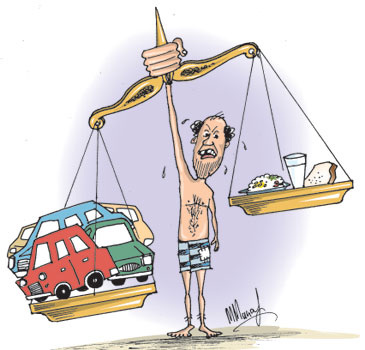

The balance of payments is the difference between a nation’s receipts of foreign currency and its expenditures of foreign currency. A nation’s balance of payments affects its exchange rate. The world price of a country’s currency tends to rise if the countries receipts exceed its expenditures. This condition is called a balance-of-payments surplus. A nation’s currency will tend to decline on world markets if more money flows out of the country than comes in. this condition is called a balance-of-payments deficit.

The primary influences on the balance of payments are income levels and rates of inflation. Suppose income levels rise more quickly abroad than in the United States. People in other countries then will increase their imports of American goods. The United States will export more than it imports, creating a balance-of-payments surplus and causing the world price of U.S. dollars to increase. If inflation causes prices to rise more quickly in the United States than aboard, foreign goods become cheaper for Americans to buy and they import more. This situation creates a balance-of-payments deficit and causes the U.S dollar to drop in price.

International reserves. A large number of countries use official holdings of foreign currency to stabilize exchange rates and to pay international debts. These holdings are called international reserves. The U.S. dollar plays a special role in international reserves, partly because the United States is one of the world’s leading trading nations. Many countries keep nearly all their international reserves in U.S. dollars, and most countries are willing to accept payment in dollars. To some extent, the U.S. dollar thus functions as an international medium of exchange.

The International Monetary Fund (IMF) is an organization that works to improve financial dealings between countries. The International Monetary Fund has introduced a type of international reserves called Special Drawing Rights (SDR’s). Member countries of the IMF can use these reserves to settle accounts among themselves. Unlike other reserves, SDR’s exist only as entries on the account books of the IMF. Some economists think SDR’s eventually will become widely used as an international medium of exchange.

The primary influences on the balance of payments are income levels and rates of inflation. Suppose income levels rise more quickly abroad than in the United States. People in other countries then will increase their imports of American goods. The United States will export more than it imports, creating a balance-of-payments surplus and causing the world price of U.S. dollars to increase. If inflation causes prices to rise more quickly in the United States than aboard, foreign goods become cheaper for Americans to buy and they import more. This situation creates a balance-of-payments deficit and causes the U.S dollar to drop in price.

International reserves. A large number of countries use official holdings of foreign currency to stabilize exchange rates and to pay international debts. These holdings are called international reserves. The U.S. dollar plays a special role in international reserves, partly because the United States is one of the world’s leading trading nations. Many countries keep nearly all their international reserves in U.S. dollars, and most countries are willing to accept payment in dollars. To some extent, the U.S. dollar thus functions as an international medium of exchange.

The International Monetary Fund (IMF) is an organization that works to improve financial dealings between countries. The International Monetary Fund has introduced a type of international reserves called Special Drawing Rights (SDR’s). Member countries of the IMF can use these reserves to settle accounts among themselves. Unlike other reserves, SDR’s exist only as entries on the account books of the IMF. Some economists think SDR’s eventually will become widely used as an international medium of exchange.

RSS Feed

RSS Feed