Early people had no system of money as we know it. To get the things they wanted, people used the barter system of trading. Gradually, people learned that almost everyone would accept certain goods in exchange for any product or service. These goods included animal hides, cattle, cloth, salt, and articles of gold or silver. People began to use such merchandise as mediums of exchange, much as we use money. Many people still use barter, especially in the developing countries of Africa, Asia, and Latin America. Millions of families in these countries live by farming and produce barely enough food to meet their own needs. As a result, they seldom acquire any money and must use barter to obtain the things they want. People in industrial countries also turn to barter if money becomes scarce or worthless. For example, barter became widespread in Germany after the country’s defeat in world war II (1939-1945). German money became almost worthless, and people refused to take it. Instead, they bartered for most goods and services. They also used cigarettes, coffee, and sugar, which were in short supply, as mediums of exchange.The first coins may have been made during the 600 B.C in Lydia, a country in what is now western Turkey. The coins were bean-shaped lumps of electrum, a natural mixture of gold and silver. The coins had a stamped design to show that the king of Lydia guaranteed them to be of uniform value. The designs saved people the trouble of weighing each coin to determine its value. Traders accepted these coins instead of cattle, cloth, gold dust, or other goods as a medium of exchange. Other countries saw the advantages of the Lydian coins and began to make their own coins. Many historians believe that coins were also invented independently in ancient China and in India. At first, the Chinese used knives, spades, and other metal tools as mediums of exchange. As early as 1100 B.C they began to use miniature bronze tools developed into coins. Coins today have many of the same features that they had in ancient times. For example, they have a government-approved design stamped on them, like the coins of ancient Lydia. The development of paper moneyThe development of paper money began in china, probably during the A.D 600 s. The Italian trader Marco polo traveled to china in the 1200 s and was amazed to see the Chinese using paper money instead of coins. In a book about his travels, polo wrote: “All his [the Chinese emperor’s] subject receive it [ paper money] without hesitation because, wherever their business may call them, they can dispose of it again in the purchase of merchandise they may require”. In spite of polo’s description, Europeans could not understand how a piece of paper could be valuable. They did not adopt the use of paper money until the 1600s. when banks began to issue paper bills, called bank notes, to depositors and borrowers. The notes could be exchanged for gold or silver coins on deposit in the bank. Until the 1800s, most of the paper bills in circulation were notes issued by banks or private companies rather than by governments. Some of the first paper currency in North America consisted of playing cards. This playing-cards money was introduced in Canada in 1685. Canada was then a French colony. Money to pay the French soldiers stationed there had to be shipped from France. Shipments were often delayed, however, and cash grew so scare that the colonial government began to issue playing cards as currency. Each card was marked a certain value and signed by the governor. Such playing-card money circulated for more than 70 years.

United States currency today consists of coins and paper money. Under federal law, only the Department of the treasury and the Federal System may issue U.S. currency. The Treasury issue all coins. The Federal Reserve issue paper currency called Federal Reserve notes. All U.S. currency carries the nation’s official motto, in Gold We Trust. Coins come in six denominations (values). These are (1) penny, or 1 cent; (2) nickel, or 5 cents; (3) dime, or 10 cents; (4) quarter, or 25 cents; (5) half dollar, or 50 cents; and (6) $1. All coins are made of alloys (mixtures of metals). Pennies are copper-coated zinc. Nickels are a mixture of copper-coated zinc. Nickels are mixture of copper and nickel. Dimes, quarters, half dollars, and dollars are made of three layers of metal. The core is pure copper. The outer layers of dimes, quarters, half dollars, and Susan B. Anthony dollars are an alloy of copper and nickel. The outer layers of golden dollars are an alloy of copper, zinc, manganese, and nickel. Dimes, quarters, half dollars, and Susan B. Anthony dollars have ridges called reeding or milling around the Large U.S. bills include Federal Reserve notes in denominations of $500, $1,000, $5,000, and $10,000. The government began withdrawing such bills from circulation in 1969. Edge. The reeding on a dime distinguishes in from a penny, which has a smooth edge. Coins must be dated with the year they were made and must bear the word liberty and the Latin motto E Pluribus Unum, meaning out of many, one. This motto refers to the creation of the United States from the original Thirteen Colonies. Mints in Denver and Philadelphia make most coins for general circulation. Mints in San Francisco and West Point, New York, make, mostly commemorative coins to mark special occasions, and gold and silver bullion coins for investors. People buy bullion coins for the value of the metal they contain. Coins made in Denver are marked with a small D.A.P appears on most coins made in Philadelphia. Some coins made in West Point are marked with an s, and some made in West Point are marked with a W.

Federal Reserve notes make up nearly all the paper money in the United States. Hundreds of billions of dollars of these notes are in circulation. They come in seven denominations: $1, $2, $5, $10, $20, $50, and $100. The notes are issued by the 12 federal Reserve Banks in the Federal Reserve System. Each note has marking that identify the bank which issued it. In addition, each note bears the words Federal Reserve note and a green Treasury seal. Until 1969, Federal Reserve Banks also issued notes in four large denominations: $500, $1,000, $5,000, and $ 10,000. Other paper money circulating in the United States includes United States notes. These notes, last printed in 1968, are the descendants of Civil War greenbacks. United States notes carry the words United States note and a red Treasury Department seal. All Federal Reserve and United State notes bear the printed signatures of the person who were secretary of the treasury and treasurer of the United States at the time the notes were issued. In the 1990’s the United States began issuing redesigned Federal Reserve notes, starting With a new $ 100 bill in 1996. The government planned eventually to issue new bills for all denominations. Plans called for issuing about one redesigned denomination each year, beginning with the largest denominations and ending with the smallest. The new bills have features intended to make them harder to counterfeit. These features include a special watermark and a “security thread” that glows in the dark when exposed to ultraviolet light. The government announced that the Federal Reserve would gradually remove all the old Federal Reserve notes from circulation. However, the government placed no time limit on the removal. He old bills would keep their full face value for as long as they remained in circulation. For photographs of the old bills and of the new ones issued so far, see the Federal Reserve notes illustration with this article.

Two agencies of the U.S. Department of the Treasury manufacture currency. The United States Mint makes coins, and the Bureau of Engraving and Printing produces paper money.

Minting coins. The production of a new coin begins with artists’ proposed designs for the coin. After government officials select a design, an artist constructs a large clay model of the coin. Most models are about eight times the size of the finished coin. The artist does not add details because the clay is too soft. Instead, the artist makes a mold of the clay model and then makes a plaster cast from the mold. The plaster is hard enough to enable the artist to carve fine details. A machine called a reducing lathe traces the finished plaster model and carves the design, reduced to coin size, onto a soft piece of steel called a master hub. The master hub is heat-treated to harden it. A special machine takes an impression of the hub to make a set of steel tools called master dies. These dies are used to stamp copies of the master hub called working hubs. The working hubs are employed, in turn, to make working dies, which stamp the coins. The master hub and master dies are stored and used to make more hubs and dies after the first ones wear out.

Bars of metal are heated and squeezed between heavy rollers into strips the thickness of a coin. A machine punches out smooth disks of metal, called blanks, from the strips. The blanks are the size of coins but have no design. The blanks are the fed into an upsetting machine. Which puts a raised rim around the edge of each one. Then, they are fed into a coining press. The press uses two working dies to impress the coin’s design on both sides of each blank in one operation. The press also reeds the edge of all coins except pennies and nickels.

The mint ships the finished coins to Federal Reserve Banks for distribution to commercial banks. The Reserve Banks also remove worn and damaged coins from circulation. The mint melts these coins and uses the metal to make new coins.

The production of a new bill begins when artists sketch their designs for it. The secretary of the treasury must approve the final design. Engravers cut the design into a steel plate. A machine called a transfer press squeezes the engraving against a soft steel roller, making a raised design on its surface. After the roller is heat-treated to harden it, another transfer press reproduces the design from the roller 32 times on a printing plate. Each plate prints a sheet of 32 bills. Separate plates print the two sides of the bills. Many people believe the paper used for money is made b a secret process. But the government publishes a detailed description of the paper so private companies can compete for the contract to manufacture it. A U.S. law forbids unauthorized people to make any type of paper similar to that used for money. The Bureau of Engraving and Printing uses high speed presses to print sheets of paper currency. The design is printed first. Then the seals and serial numbers are added. The sheets are cut into stacks of bills. Imperfect bills are replaced with new ones called star notes. Each star note has the same serial number as the bill it replaces, but a star after the number shows that it is a replaces, but a star after the number shows that it is a replacement bill. The bills are shipped to Reserve Banks, which distribution them to commercial banks. Most $1 bills wear out after about 18 month in circulation. Larger denominations last for years because they are handled less often. Banks collect worn-out bills and ship them of Federal Reserve Banks for replacement. The Reserve Banks destroy worn-out money in shredding machines.

During the early 1800s, the only paper money in the united states consisted of hundreds of kinds of bank notes. Each bank promised to exchange its notes on demand for gold or silver coins. But numerous banks did not keep enough coins to redeem their notes. Many notes therefore were not worth their face value—that is, the value stated on them. As a result, people hesitated to accept bank notes. The soundest bank notes of the early 1800s were issued by the two national banks chartered by the U.S. government. The first bank of the United States was chartered by Congress from 1791 to 1811, and the Second bank of the United State from 1816 to 1836. Both banks supported their notes with reserves of gold coins, and people considered the notes as good as gold. Paper money as we know it today dates from the 1860s. to help pay the costs of the American Civil War (1861-1865), the U.S. government issued about $430 million in paper money. The money could not be exchanged for gold or silver. The bills were called legal tender notes or United States notes. But most people called them greenbacks because the backs were printed in green. The government declared that greenbacks were legal tender—that is, money people must accept in payment of public and private debts. Nevertheless, the value of greenbacks depended on people’s confidence in the government. That confidence rose and fell with the victories and defeats of the North in the Civil War. At one time, each greenback dollar was worth only 35 cents in gold coin. In the South, the Confederate States also issued paper money. It quickly became almost worthless. In 1863 and 1864, Congress passed the National Bank Acts, which set up system of privately owned banks chartered by the federal government. These national banks issued notes backed by U.S. government bonds. Congress also taxed state bank notes to discourage their use. As a result, national bank notes became the country’s chief currency. Some greenbacks also continued to circulate. The government announced that, beginning in 1879, it would pay gold coins for greenbacks. The U.S. Department of the Treasury gathered enough gold to redeem all the greenbacks likely to be brought in. but as soon as people knew they could exchange their greenbacks for gold, they were not anxious to do so. The fact that the Treasury paid out only gold coins meant the country was operating on an unofficial gold standard, rather than the bimetallic standard of the early 1800s. The gold standard is a system in which a nation defines its basic monetary unit as worth a certain quantity of gold and agrees to redeem its money in gold on demand. The new nation banks system eliminated the confusion that had existed when hundreds of different bank notes were in circulation. But the system did not provide for the federal government to increase the supply of money when needed. Shortages of money contributed to a series of economic slumps during the late 1800’s. many people called for the government to provide more money by coining unlimited amounts of silver. Such a policy was called free silver, and the argument over free silver became an important political issue. The dispute reached a climax during the presidential election of 1896. The republican candidate, William McKinley, favored the gold standard. McKinley defeated William Jennings Bryan, the Democratic candidate, who supported free silver (see Free silver). In 1900, congress passed the Gold Standard Act, which officially put the nation on a gold standard. The United States went on and off the gold standard several times and finally abandoned it in 1971 (see Gold standard). The United States suffered from repeated monetary difficulties until 1913, when Congress passed the Federal Reserve Act. This act created the Federal Reserve System, a central banking System interest rates and the availability of money and loans.

The quantity of money in a country affects the level of prices, the rate of economic growth, and therefore the amount of employment. If the money supply increases, people have extra money to buy things, and their demand, manufacturers hire more workers to increase output. Earnings rise and spending increases, leading to further economic growth. However, if output cannot keep pace with demand, prices will increase. A continuing rise in prices is called inflation. Inflation may cause problems for people whoso income does not keep pace with rising prices. If the money supply shrinks, people have less to spend. Goods and services remain unsold. Prices fall. Manufacturers cut back on production, and many businesses lay off workers.

The main economic goals of early all nations are to promote economic growth and high employment with a minimum increase in prices. A government’s chief methods of promoting these goals are by its monetary policy and its fiscal policy. Monetary policy refers to how a government influences such factors as interest rates, the availability of loans, and the money supply. Fiscal policy refers to a government’s taxing and spending programs. To simulate the economy, a government may reduce interest rates, increase the money supply, reduce taxes, or boost its own spending. The following discussion focuses on monetary policy. For details on fiscal policy, see Economics (Economic stability).

The value of money is defined by economists as the quantity of goods and services that the money will buy. If prices go up or down, the value of money also changes. A major aim of any government’s monetary policy is to keep prices stable and thus preserve the value of money, also called its purchasing power. Today, people worry most about inflation, which lowers the value of money. If prices double, for example, a dollar buys only half as much as before, and so the value of money has dropped one-half. The rate of inflation is the rate at which prices in general are rising and the rate at which the value of money is falling.

Rapid, uncontrolled inflation can severely damage a country’s economy. For example, prices in Germany increased 10 billion times from August 1922 to November 1923. Such severe inflation is called hyperinflation. The value of the German mark dropped so sharply and so rapidly that employers paid workers twice a day. Marks became so worthless that no one would take them, and people began to use barter instead of money. Employers paid workers by giving them some of the goods they produced. People spent so much time trading for the things they needed that production nearly came to a halt. The hyperinflation ended after the government introduced a new currency.

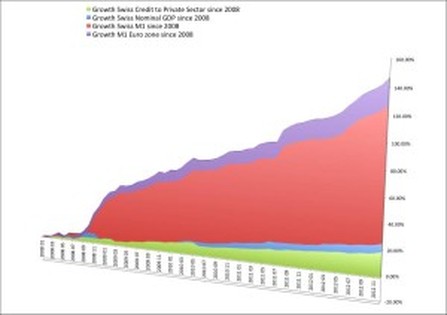

Inflation has many causes. But in most cases, prices cannot continue to rise without increases in the quantity of money. There never has been severe inflation without a large expansion in a nation’s money supply.

The money supply includes more than just coins and paper money. In fact, checking account deposits are the most common form of money in the United States and many other countries. In the United States, about three—fourths of all payments are made by check. Checks are a safe and convenient medium of exchange. In addition, a canceled check provides written proof that payment was made.

Economists define the money supply in various ways, depending on which assets they include in their measurements. The definitions change as the banking system changes. Two major definitions of the U.S. money supply are called M-1 and M-2.

M-1 consist of checking account deposits, also called demand deposits; traveler’s checks; and currency. In the mid-1990’s, M-1 totaled about $1,125 billion.

M-2 consists of M-1 plus money invested in savings accounts at commercial banks, at savings banks, and at savings and loan associations. Such savings, called time deposits, are not immediately available to make purchases. The saver first has to withdraw the money, and the bank can require advance notice of withdrawal. However, most people can easily convert their savings to cash or checking deposits. M-2 amounted to about $3,560 billion in the mid-1990’s.

he size a nation’s money supply is determined differently if the nation uses commodity money or fiat money. Commodity money typically consists of valuable metals, especially gold or silver. Fiat money, typically paper money or coins, is of less value as a commodity than as money. It has value as money because people are willing to accept it. To increase the chance of people accepting its money, a government may make the currency legal tender. Then, the law requires people to accept the money at face value. If a nation uses commodity money, the money supply is determined by the cost of producing the metal and the rate of production. During the late 1800’s and the early 1900’s, the United States and many other countries were on the gold standard, which is a commodity money system. Each nation promised to redeem its currency for a specified amount of gold. For example, a United States dollar was officially valued at about 26 grains (1.7 grams) of gold. The amount of money that countries could issue depended on how much gold was being mined in the world. A decline in gold output during the 1870’s and he 1880’s slowed the growth of the money supply and caused prices to fall. The economic problems ended only after the discovery of new gold fields in South Africa and after the invention of a more efficient method of extracting gold from the rocks in which it is found. The United States and most other countries today are on the fiat money system. Under this system, the money supply does not depend on the production of any commodity. Instead, the national government largely determines the money supply though its monetary policy. The monetary policy is conducted by the nation’s central bank, which is a government agency in most countries. The central bank issue currency, regulates the activities of the nation’s commercial banks, and performs other financial services for the government. The Federal Reserve System is the central bank of the United States. The central bank of Canada is the Bank of Canada. Other central banks include the Bank of England in the United Kingdom, the Banque de France in France, and the Deutschland Bundesbank in Germany.

|

RSS Feed

RSS Feed